Introduction

Endoscope cleaning and disinfecting devices are vital components in healthcare settings, ensuring that reusable endoscopes are properly sanitized to prevent infection transmission. As the use of endoscopic procedures increases globally, the demand for efficient and automated cleaning and disinfecting systems continues to rise. This market is closely driven by healthcare regulations, advancements in medical device technologies, and a rising focus on patient safety.

This article explores the Endoscope Cleaning and Disinfecting Device Market in detail, highlighting market dynamics, technological developments, segmentation, regional insights, and future prospects up to 2033.

Market Overview

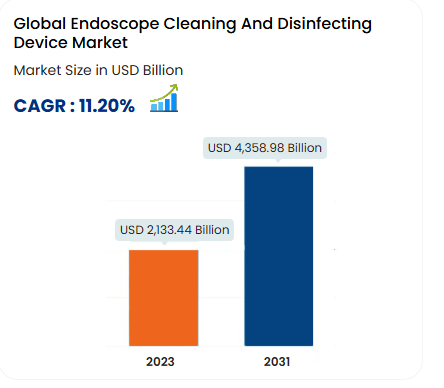

The global Endoscope Cleaning and Disinfecting Device Market was valued at approximately USD 1.7 billion in 2024 and is projected to reach around USD 3.2 billion by 2033, expanding at a CAGR of 7.2% during the forecast period. This growth is propelled by increasing endoscopic procedures, stricter infection control protocols, and the growing adoption of automated reprocessing systems in hospitals and clinics.

Key Market Drivers

-

Rising Volume of Endoscopic Procedures

The global increase in minimally invasive surgeries and diagnostic procedures is boosting the need for reusable endoscopes and their reprocessing systems. -

Strict Regulatory Standards

Government and international health bodies have mandated stringent disinfection and sterilization protocols, pushing healthcare providers to adopt advanced cleaning devices. -

Emphasis on Infection Control and Patient Safety

High-profile cases of infection transmission through improperly cleaned endoscopes have led to increased awareness and institutional investments in reliable disinfection systems. -

Technological Advancements in Reprocessing Equipment

Innovations such as automated endoscope reprocessors (AERs), enhanced drying systems, and real-time monitoring features are increasing the efficiency and safety of the cleaning process. -

Growth of Healthcare Infrastructure in Developing Nations

Expanding hospitals and outpatient facilities in emerging economies are investing in advanced cleaning and disinfecting devices to comply with global health standards.

Market Segmentation

-

By Product Type

-

Endoscope Cleaning Devices

-

Endoscope Disinfecting Devices

-

Automated Endoscope Reprocessors (AERs)

-

Drying and Storage Cabinets

-

Accessories and Consumables

-

-

By End User

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Specialty Clinics

-

Diagnostic Centers

-

-

By Cleaning Method

-

Manual Cleaning

-

Automated Cleaning

-

Regional Insights

-

North America

North America dominates the market due to its advanced healthcare infrastructure, strong regulatory enforcement, and early adoption of automated reprocessing technologies. The U.S. leads in terms of market share. -

Europe

Europe follows closely with stringent infection control standards and a well-developed public healthcare system. Countries such as Germany, France, and the U.K. are significant contributors. -

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rising healthcare investments, increasing endoscopy procedures, and growing awareness about cross-contamination risks. China, India, and Japan are key growth areas. -

Latin America and Middle East & Africa

These regions show steady growth with improving healthcare access and international support for infection prevention programs. Brazil, Mexico, Saudi Arabia, and South Africa are noteworthy markets.

Technological Trends

-

Automation and Robotics

Automated endoscope reprocessors are reducing the reliance on manual labor while enhancing consistency and compliance with cleaning protocols. -

Digital Tracking and Reporting

New systems feature tracking of each reprocessing cycle, real-time alerts, and digital records to support audits and ensure traceability. -

Eco-Friendly Disinfection Solutions

Manufacturers are developing systems that use environmentally safe disinfectants and reduce water and energy consumption. -

Integration with Hospital IT Systems

Smart reprocessing devices are now capable of integrating with hospital networks to enable centralized data access and better infection control monitoring.

Challenges

-

High Capital Investment

Initial costs for automated cleaning and disinfecting devices can be significant, posing adoption barriers for smaller facilities. -

Maintenance and Training Requirements

Proper operation of these systems requires skilled personnel and ongoing maintenance, which can add to the total cost of ownership. -

Risk of Device Malfunction or Human Error

Despite automation, incorrect settings or poor maintenance can compromise the cleaning process, leading to infection risks. -

Disparity in Global Healthcare Standards

Lack of uniformity in regulations and standards across different regions can impact the global market’s consistent growth.

Competitive Landscape

Key players in the Endoscope Cleaning and Disinfecting Device Market focus on product innovation, regulatory approvals, and geographic expansion. Leading companies include:

-

Olympus Corporation

-

STERIS plc

-

Getinge AB

-

Ecolab Inc.

-

Cantel Medical (Sotera Health)

-

Belimed AG

-

Steelco S.p.A.

-

Wassenburg Medical

-

ARC Healthcare Solutions

-

Matachana Group

Future Outlook (2025–2033)

-

Integration with AI and IoT

Advanced systems may utilize AI for cycle optimization and IoT for predictive maintenance and remote monitoring. -

Focus on Portability and Space Efficiency

Compact and mobile systems are expected to gain popularity in small-scale and decentralized healthcare settings. -

Stringent Global Guidelines

Harmonization of international disinfection standards will drive broader adoption of sophisticated reprocessing technologies. -

Rise in Disposable and Single-Use Endoscope Markets

While reusable scopes dominate, the growth of single-use endoscopes may slightly impact the long-term demand for cleaning systems.

Conclusion

The Endoscope Cleaning and Disinfecting Device Market is poised for robust growth, fueled by rising procedural volumes, strict regulatory frameworks, and growing awareness about infection control. With continued innovation and an emphasis on automation and safety, the market is expected to evolve significantly over the next decade, supporting improved patient outcomes and operational efficiency across global healthcare systems.